Life insurance quotes are essential for securing your family’s financial future. Understanding the intricacies of these quotes can empower you to make informed decisions about your coverage needs. From the different types of policies available to the factors that influence pricing, we’ll explore the world of life insurance quotes in detail.

This comprehensive guide will walk you through the process of obtaining a quote, analyzing its elements, and making informed choices that align with your unique circumstances. Whether you’re a young professional starting out or a seasoned individual looking to update your coverage, this information will be invaluable.

Understanding Life Insurance Quotes

A life insurance quote is an estimate of the premium you’ll pay for a life insurance policy. It’s crucial to understand life insurance quotes because they provide a clear picture of the cost of coverage and help you make informed decisions about your insurance needs.

Factors Influencing Life Insurance Quotes

Several factors determine the cost of your life insurance quote. These factors are used by insurance companies to assess your risk and determine the premium you’ll pay.

- Age:Younger individuals generally pay lower premiums than older individuals because they have a longer life expectancy.

- Health:Your health plays a significant role in determining your life insurance quote. Individuals with pre-existing health conditions may pay higher premiums.

- Lifestyle:Your lifestyle, including your hobbies and occupation, can also impact your quote. For example, someone who engages in high-risk activities, such as skydiving, may pay higher premiums.

- Policy Type:Different types of life insurance policies come with varying premiums. Term life insurance, for example, is generally more affordable than permanent life insurance.

- Death Benefit:The amount of coverage you choose will also influence your premium. Higher death benefits typically mean higher premiums.

- Gender:Historically, women have had longer life expectancies than men, leading to lower premiums for women. However, this difference is narrowing, and some insurance companies are now offering gender-neutral rates.

- Smoking Habits:Smokers are considered higher risk and generally pay higher premiums than non-smokers.

Types of Life Insurance Policies and Their Quotes

The type of life insurance policy you choose will affect the cost of your premiums. Here are some common types:

- Term Life Insurance:This type of policy provides coverage for a specific period, such as 10, 20, or 30 years. Term life insurance is typically the most affordable option, making it suitable for temporary needs, such as covering a mortgage or supporting a family while children are young.

- Whole Life Insurance:Whole life insurance offers lifelong coverage and includes a cash value component that grows over time. It’s more expensive than term life insurance, but it provides permanent coverage and a savings element.

- Universal Life Insurance:Universal life insurance provides flexible premiums and death benefits. It also includes a cash value component that earns interest.

- Variable Life Insurance:Variable life insurance allows you to invest your premiums in sub-accounts that offer potential growth. However, it also carries investment risk.

Obtaining a Life Insurance Quote

Once you understand the basics of life insurance, you’re ready to start getting quotes. This process helps you compare different policies and find the one that best suits your needs and budget.

Online Platforms and Resources

Online platforms offer a convenient and efficient way to obtain life insurance quotes. Several websites and tools allow you to compare quotes from multiple insurers in one place. These platforms often provide a streamlined application process and quick turnaround times for quotes.

- Comparison websites:Websites like Policygenius, NerdWallet, and Insurance.com allow you to compare quotes from multiple insurers simultaneously. You can filter quotes based on your specific needs and preferences, such as coverage amount, policy type, and budget.

- Insurer websites:Most life insurance companies have online quote tools on their websites. These tools typically ask for basic information about yourself, your health, and your desired coverage.

- Independent insurance agents:Some independent insurance agents have websites that allow you to get quotes from different insurers. These agents can provide personalized guidance and help you navigate the process.

Working with an Insurance Agent

Working with an insurance agent can be beneficial, especially if you’re unfamiliar with life insurance or have complex needs. Agents can provide personalized advice, answer your questions, and help you understand the different policy options available.

- Expertise and guidance:Insurance agents have extensive knowledge of the life insurance market and can help you navigate the complex world of policies and terms. They can explain the different types of coverage, benefits, and exclusions.

- Personalized recommendations:Agents can assess your individual needs and circumstances to recommend the most suitable policy for you. They can help you determine the right coverage amount, policy type, and features based on your financial goals and family situation.

- Negotiation and support:Agents can help you negotiate with insurers to secure the best possible rates and coverage. They can also provide ongoing support throughout the application and policy management process.

Going Directly to an Insurer

Going directly to an insurer allows you to interact with the company directly and potentially obtain quotes without any intermediary. This can be a more streamlined approach, but it may require more research and effort on your part.

- Direct interaction:You can access the insurer’s website or contact their customer service department directly to obtain quotes. This eliminates the need for a third-party intermediary.

- Potentially lower costs:Insurers may offer slightly lower rates when you go directly to them, as they don’t have to pay commissions to agents. However, this is not always the case.

- Greater control:You have more control over the process when you go directly to an insurer. You can choose the specific policy features and options that best suit your needs.

Analyzing Life Insurance Quotes

You’ve received several life insurance quotes, and now it’s time to compare them carefully to find the best policy for your needs. Analyzing life insurance quotes involves more than just looking at the premium amount. Understanding the key elements and comparing them across different providers is crucial to make an informed decision.

Essential Elements of a Life Insurance Quote

The essential elements of a life insurance quote include the premium, coverage amount, and policy terms. These elements are crucial for understanding the value and cost of the policy.

- Premium:The premium is the amount you pay periodically (monthly, quarterly, or annually) for your life insurance coverage. It’s calculated based on factors like your age, health, lifestyle, and the coverage amount you choose.

- Coverage Amount:This is the amount of money your beneficiaries will receive upon your death. It’s also known as the death benefit. The coverage amount should be sufficient to meet your family’s financial needs after your passing, such as paying off debts, covering living expenses, and funding your children’s education.

- Policy Terms:The policy terms Artikel the specific conditions and rules of your life insurance policy. They include details like the policy’s duration, the grace period for premium payments, and any exclusions or limitations.

Comparing Life Insurance Quotes

When comparing life insurance quotes, it’s important to consider several factors beyond just the premium.

- Coverage Amount:Ensure that the coverage amount offered by each provider is sufficient to meet your family’s financial needs. Compare the coverage amounts across different quotes and consider the impact of inflation on future needs.

- Premium:While premium is a significant factor, don’t solely focus on the lowest premium. Consider the value offered by each policy, including the coverage amount, policy terms, and the insurer’s financial stability and reputation.

- Policy Terms:Carefully review the policy terms of each quote. Pay attention to the duration of the policy, grace period for premium payments, any exclusions or limitations, and the insurer’s claims process.

- Insurer’s Financial Stability:Check the financial stability of the insurance companies providing the quotes. Look for insurers with a strong track record of paying claims and a good financial rating from independent agencies like A.M. Best or Standard & Poor’s.

- Customer Service:Consider the insurer’s reputation for customer service. Look for companies known for their responsiveness, helpfulness, and ease of communication.

Calculating the Cost of Life Insurance

Calculating the cost of life insurance depends on your individual needs and circumstances. Consider the following factors:

- Your Age:Younger individuals typically pay lower premiums than older individuals.

- Your Health:Individuals with good health generally pay lower premiums than those with pre-existing health conditions.

- Your Lifestyle:Factors like smoking, drinking, and dangerous hobbies can influence your premium.

- Coverage Amount:The higher the coverage amount, the higher the premium.

- Policy Term:Longer policy terms usually result in higher premiums, but offer longer-term coverage.

You can use online life insurance calculators or consult with a financial advisor to estimate the cost of life insurance based on your specific circumstances.

Factors Influencing Life Insurance Quotes

Life insurance premiums are determined by various factors, and understanding these factors can help you get the best possible quote. These factors are assessed by insurance companies to determine your risk profile, which influences the cost of your policy.

Factors Influencing Life Insurance Quotes

The following table Artikels the major factors influencing life insurance quotes:| Factor | Description | Impact on Quote ||—|—|—|| Age| Your age is a key factor, as older individuals have a higher risk of mortality. | Higher age generally results in higher premiums.

|| Health| Your overall health status, including medical history and current conditions, plays a significant role. | Pre-existing conditions or poor health can lead to higher premiums or even denial of coverage. || Lifestyle| Your lifestyle choices, such as smoking, alcohol consumption, and dangerous hobbies, are considered.

| Engaging in risky behaviors can increase premiums. || Coverage Amount| The amount of death benefit you choose, which is the amount your beneficiaries will receive upon your death. | Higher coverage amounts generally result in higher premiums. || Policy Type| The type of life insurance policy you choose, such as term life or whole life.

| Different policy types have varying premiums, with term life typically being more affordable. || Gender| Historically, women have lived longer than men, but this gap is narrowing. | Historically, women have paid lower premiums, but this trend is changing.

|| Occupation| Your profession can influence your risk of mortality, with certain occupations considered more dangerous. | High-risk occupations may result in higher premiums. || Family History| Your family history of certain diseases or conditions can impact your risk assessment.

| A family history of early-onset diseases may lead to higher premiums. |

Premium Differences Based on Policy Features, Life insurance quote

The following table compares the premium differences for different life insurance policies based on factors like term length, coverage amount, and policy features:| Policy Type | Term Length | Coverage Amount | Policy Features | Premium ||—|—|—|—|—|| Term Life | 10 years | $250,000 | No cash value, death benefit only | $25 per month || Term Life | 20 years | $500,000 | No cash value, death benefit only | $50 per month || Whole Life | Lifetime | $250,000 | Cash value accumulation, death benefit | $100 per month || Whole Life | Lifetime | $500,000 | Cash value accumulation, death benefit | $200 per month || Universal Life | Flexible | $250,000 | Flexible premiums, cash value | $75 per month || Universal Life | Flexible | $500,000 | Flexible premiums, cash value | $150 per month |

Impact of Various Factors on Life Insurance Quotes

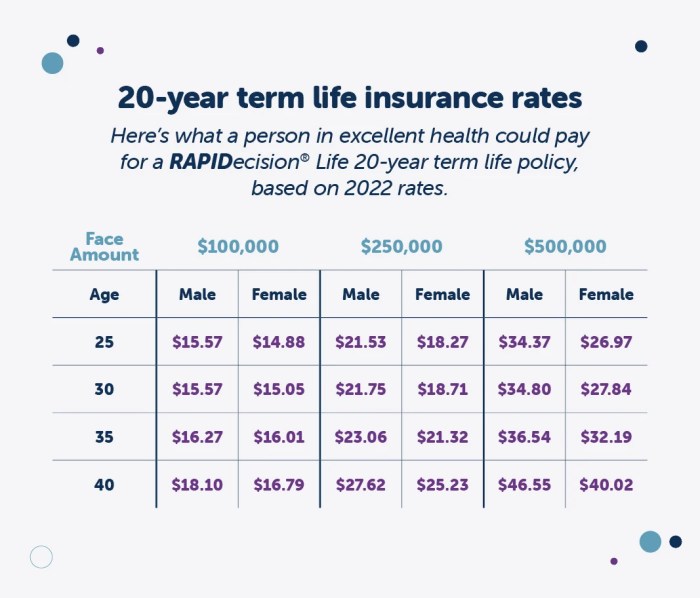

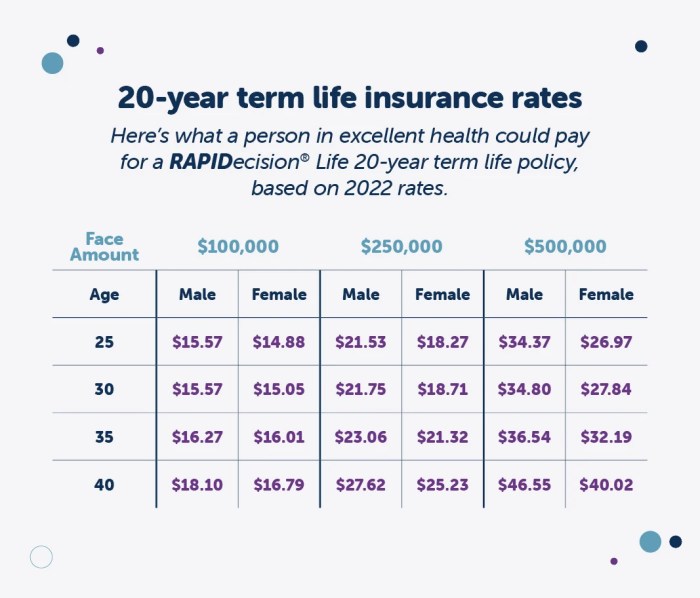

The following visual representation showcases the impact of various factors on life insurance quotes. Chart:A bar graph depicting the average monthly premium for different age groups (25, 35, 45, 55) with a fixed coverage amount of $250,000 for a 20-year term life insurance policy.

The graph clearly illustrates the upward trend in premiums as age increases.

Life Insurance Quotes and Financial Planning

Life insurance quotes are a crucial component of comprehensive financial planning. They provide a roadmap for securing the financial well-being of loved ones in the event of your passing, ensuring that their future needs are met. By understanding the various types of life insurance and their associated costs, you can make informed decisions that align with your financial goals and personal circumstances.

Estate Planning

Life insurance quotes play a vital role in estate planning, helping to ensure that your assets are distributed according to your wishes and that your beneficiaries are financially protected. A life insurance policy can be used to cover estate taxes, funeral expenses, and other final expenses, ensuring that your loved ones are not burdened with these costs during a difficult time.

- For instance, a life insurance policy with a death benefit of $500,000 can be used to cover estate taxes on a sizable inheritance, ensuring that your beneficiaries receive the full value of your assets.

- Furthermore, life insurance can be used to fund trusts or other estate planning vehicles, allowing you to control how your assets are managed and distributed after your death.

Debt Protection

Life insurance quotes can help protect your loved ones from the burden of your outstanding debts, ensuring that they are not left with financial obligations in your absence. A life insurance policy can be used to pay off mortgages, credit card debt, and other outstanding loans, relieving your beneficiaries of these financial burdens.

- For example, a life insurance policy with a death benefit of $250,000 can be used to pay off a mortgage, ensuring that your family can continue to live in their home without the added financial pressure of a mortgage payment.

- Additionally, life insurance can provide financial security for your family in the event of unexpected death, preventing them from having to sell assets or take on additional debt to cover your outstanding obligations.

Income Replacement

Life insurance quotes can be used to replace lost income, ensuring that your family’s financial needs are met in your absence. A life insurance policy can provide a lump sum death benefit that can be used to cover living expenses, educational costs, or other financial obligations, allowing your family to maintain their standard of living without financial hardship.

- For example, a life insurance policy with a death benefit of $1 million can provide a substantial income replacement for a family with young children, ensuring that they have the financial resources to meet their ongoing needs.

- Additionally, life insurance can provide financial security for your family in the event of your unexpected death, allowing them to avoid financial stress and focus on their emotional well-being during a difficult time.

Ultimate Conclusion

By taking the time to understand life insurance quotes, you can confidently navigate the complexities of securing your family’s financial well-being. Remember, life insurance is a powerful tool that can provide peace of mind and financial security for those you love most.

Don’t hesitate to seek professional advice from an insurance agent or financial advisor to ensure your coverage meets your individual needs.

Essential Questionnaire

What is the difference between term life insurance and whole life insurance?

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It’s generally more affordable but doesn’t build cash value. Whole life insurance provides lifelong coverage and accumulates cash value, but it’s more expensive.

How often should I review my life insurance needs?

It’s recommended to review your life insurance needs every 3-5 years or whenever you experience significant life changes, such as marriage, birth of a child, or a change in financial circumstances.

What are the common exclusions in life insurance policies?

Common exclusions may include death by suicide within a certain timeframe, death due to pre-existing conditions, or death caused by engaging in risky activities.

How do I know if I need life insurance?

You may need life insurance if you have dependents who rely on your income, have outstanding debts, or want to leave a financial legacy for your loved ones.