Seven Corners Travel Insurance is a leading provider of travel protection plans designed to safeguard your adventures. Founded with the goal of making travel more accessible and worry-free, Seven Corners offers a range of comprehensive plans tailored to diverse travel needs.

From single-trip coverage for short getaways to multi-trip policies for frequent travelers, Seven Corners provides peace of mind knowing you’re covered in case of unexpected events.

Whether it’s medical emergencies, trip cancellations, lost luggage, or other travel-related issues, Seven Corners travel insurance can help mitigate financial burdens and ensure a smoother travel experience. The company’s commitment to customer satisfaction is evident in its user-friendly website, mobile app, and responsive customer support.

Seven Corners Travel Insurance Overview

Seven Corners is a leading provider of travel insurance, offering a range of plans to meet the needs of individual travelers, families, and groups. The company was founded in 2001 with a mission to provide travelers with peace of mind and financial protection during their journeys.

Seven Corners has a strong commitment to customer service and strives to make the travel insurance buying process as simple and straightforward as possible.

History and Founding

Seven Corners was founded in 2001 by a group of insurance professionals who recognized the growing need for travel insurance in the United States. The company was initially focused on providing insurance to individuals traveling to Mexico and the Caribbean, but it quickly expanded its offerings to include destinations worldwide.

Seven Corners’ commitment to customer service and innovative product development helped the company quickly gain a reputation as a leader in the travel insurance industry.

Mission and Values

Seven Corners’ mission is to provide travelers with peace of mind and financial protection during their journeys. The company’s values are based on customer focus, innovation, integrity, and teamwork. These values guide all aspects of Seven Corners’ operations, from product development to customer service.

Key Features and Benefits

Seven Corners travel insurance offers a variety of features and benefits, including:

- Medical Expenses Coverage: This coverage helps pay for medical expenses incurred while traveling, including emergency medical evacuation and repatriation.

- Trip Cancellation and Interruption Coverage: This coverage provides reimbursement for non-refundable trip costs if your trip is canceled or interrupted due to a covered reason, such as illness, injury, or natural disaster.

- Baggage and Personal Effects Coverage: This coverage helps protect your belongings against loss, theft, or damage while traveling.

- 24/7 Emergency Assistance: Seven Corners provides 24/7 emergency assistance services, including medical assistance, travel assistance, and legal assistance.

- Wide Range of Plans: Seven Corners offers a variety of plans to meet the needs of different travelers, including individual travelers, families, and groups. Plans are available for single trips, multi-trip plans, and annual travel insurance.

Types of Seven Corners Travel Insurance Plans

Seven Corners offers a variety of travel insurance plans to meet the needs of different travelers. The plans are categorized based on the type of trip, coverage options, and budget.

Single Trip Plans

Single trip plans are designed for individual trips and offer comprehensive coverage for various travel-related risks. These plans are ideal for travelers who are planning a specific trip and want to ensure their peace of mind.

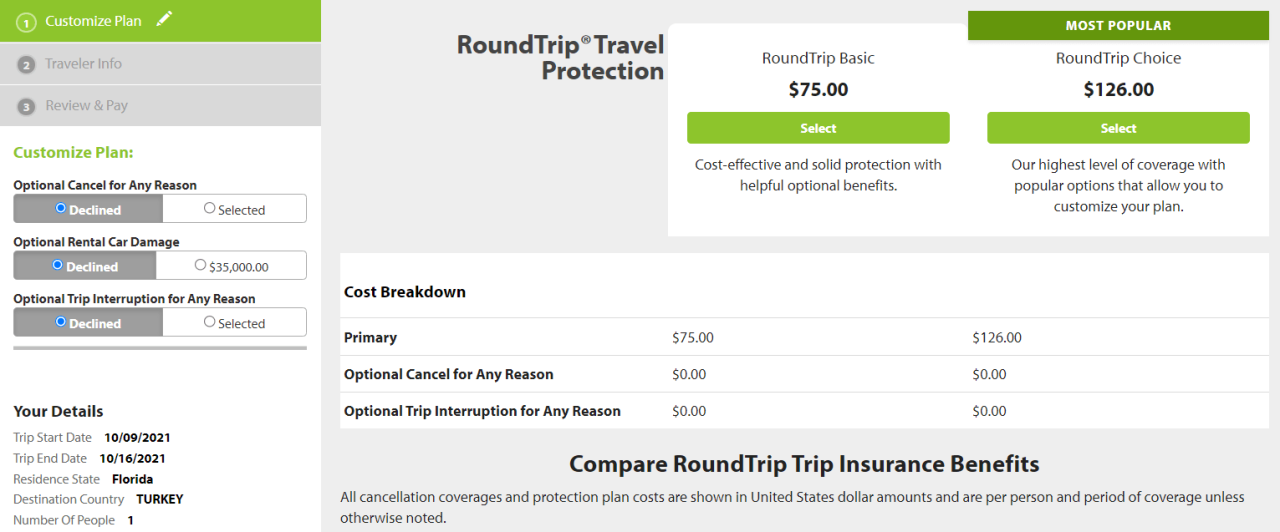

- RoundTrip: This plan provides basic coverage for medical expenses, emergency medical evacuation, and trip cancellation or interruption. It is a budget-friendly option for travelers who want essential coverage.

- RoundTrip Plus: This plan offers enhanced coverage, including baggage loss and delay, travel delay, and accidental death and dismemberment. It is a good choice for travelers who want more comprehensive coverage.

- RoundTrip Premier: This plan provides the most extensive coverage, including medical expenses, emergency medical evacuation, trip cancellation or interruption, baggage loss and delay, travel delay, accidental death and dismemberment, and more. It is the ideal choice for travelers who want the highest level of protection.

Multi-Trip Plans

Multi-trip plans are designed for travelers who frequently take multiple trips throughout the year. These plans provide coverage for all trips taken within a specific period, typically 12 months.

- Annual Travel Pro: This plan provides comprehensive coverage for multiple trips taken within a year. It includes medical expenses, emergency medical evacuation, trip cancellation or interruption, baggage loss and delay, travel delay, accidental death and dismemberment, and more. It is a cost-effective option for frequent travelers.

- Annual Travel Pro Plus: This plan offers enhanced coverage, including coverage for pre-existing conditions, which is not typically included in standard travel insurance plans. It is a good choice for travelers with pre-existing medical conditions who want peace of mind.

Family Plans

Family plans are designed to provide coverage for families traveling together. These plans offer discounts for multiple family members and provide coverage for all family members on the policy.

- Family RoundTrip: This plan provides basic coverage for medical expenses, emergency medical evacuation, and trip cancellation or interruption for the entire family. It is a budget-friendly option for families who want essential coverage.

- Family RoundTrip Plus: This plan offers enhanced coverage, including baggage loss and delay, travel delay, and accidental death and dismemberment for the entire family. It is a good choice for families who want more comprehensive coverage.

- Family RoundTrip Premier: This plan provides the most extensive coverage, including medical expenses, emergency medical evacuation, trip cancellation or interruption, baggage loss and delay, travel delay, accidental death and dismemberment, and more for the entire family. It is the ideal choice for families who want the highest level of protection.

Cost and Value Proposition

The cost of Seven Corners travel insurance plans varies depending on the plan, coverage options, and destination. The value proposition of each plan is determined by the level of coverage provided and the price. For example, the RoundTrip plan is the most affordable option but offers the least coverage, while the RoundTrip Premier plan is the most expensive but offers the most comprehensive coverage.

Travelers should carefully consider their needs and budget when choosing a Seven Corners travel insurance plan.

Seven Corners Travel Insurance Benefits

Seven Corners Travel Insurance offers a range of benefits designed to provide peace of mind and financial protection during your travels. These benefits can help cover unexpected medical expenses, trip cancellations, and other travel-related issues, allowing you to focus on enjoying your journey without the worry of unforeseen costs.

Medical Expenses

Medical expenses can be a major concern when traveling abroad. Seven Corners travel insurance can help alleviate this worry by providing coverage for various medical emergencies, including:

- Emergency Medical Evacuation:If you require urgent medical care that is unavailable at your current location, Seven Corners can arrange for your transportation to a suitable medical facility, even if it’s in another country.

- Medical Evacuation:If you require medical care that is not available at your current location, Seven Corners can arrange for your transportation to a suitable medical facility, even if it’s in another country.

- Repatriation of Remains:In the unfortunate event of a traveler’s death, Seven Corners can help with the repatriation of their remains to their home country.

- Emergency Medical Expenses:Seven Corners can cover a wide range of medical expenses incurred during your trip, including doctor visits, hospital stays, and prescription medications.

For example, a traveler who fell ill while on a backpacking trip in Southeast Asia was able to receive emergency medical evacuation back to their home country with the help of Seven Corners travel insurance. The insurance covered the costs of the medical evacuation, as well as the associated medical expenses, saving the traveler from significant financial burden.

Trip Cancellation and Interruption

Travel plans can be disrupted by unforeseen circumstances, such as illness, natural disasters, or family emergencies. Seven Corners travel insurance can provide financial protection in these situations, offering coverage for:

- Trip Cancellation:If you have to cancel your trip due to a covered reason, Seven Corners can reimburse you for your non-refundable trip expenses, such as flights, accommodation, and tours.

- Trip Interruption:If you have to cut your trip short due to a covered reason, Seven Corners can help cover the costs of returning home, as well as any additional expenses incurred due to the interruption.

A traveler who had to cancel their European vacation due to a family emergency was able to recover their non-refundable trip expenses thanks to their Seven Corners travel insurance. The insurance policy covered the costs of flights, accommodation, and other pre-paid expenses, minimizing the financial impact of the unexpected cancellation.

Baggage and Personal Effects

Losing or damaging your luggage while traveling can be a stressful experience. Seven Corners travel insurance offers coverage for:

- Lost or Damaged Luggage:If your luggage is lost, stolen, or damaged during your trip, Seven Corners can help cover the costs of replacing your belongings.

- Delayed Luggage:If your luggage is delayed during your trip, Seven Corners can provide reimbursement for essential items you need to purchase until your luggage is recovered.

A traveler whose luggage was lost during a flight to South America was able to receive compensation for the cost of replacing their lost belongings through their Seven Corners travel insurance. The insurance covered the cost of essential items like clothing, toiletries, and other personal effects, providing relief during a stressful situation.

Other Benefits

In addition to the core benefits mentioned above, Seven Corners travel insurance may also offer coverage for:

- Emergency Assistance:Seven Corners can provide 24/7 emergency assistance services, such as medical referrals, legal assistance, and translation services.

- Travel Delay:If your trip is delayed due to a covered reason, Seven Corners can help cover the costs of meals, accommodation, and other expenses incurred during the delay.

- Accidental Death and Dismemberment:Some Seven Corners travel insurance plans offer coverage for accidental death and dismemberment, providing financial support to your beneficiaries in the event of a tragic accident.

A traveler whose flight was delayed due to a mechanical issue was able to use their Seven Corners travel insurance to cover the costs of meals and accommodation during the delay. The insurance provided peace of mind and financial support during a stressful situation, allowing the traveler to focus on getting to their destination.

Seven Corners Customer Experience

Understanding how Seven Corners interacts with its customers is crucial when considering travel insurance. This section delves into customer feedback, website usability, and customer service comparisons to paint a comprehensive picture of the Seven Corners experience.

Customer Reviews and Testimonials

Customer feedback provides valuable insights into the strengths and weaknesses of a company. Seven Corners boasts a mix of positive and negative reviews, reflecting the varied experiences of its customers.

- Positive Reviews:Many customers praise Seven Corners for its comprehensive coverage options, competitive pricing, and responsive customer service. They appreciate the ease of filing claims and the helpfulness of Seven Corners representatives. Some customers have even shared stories of how Seven Corners saved them from significant financial losses during travel emergencies.

- Negative Reviews:Some customers express dissatisfaction with the claims process, citing delays and difficulties in obtaining reimbursements. Others find the website confusing or challenging to navigate. There are also instances where customers feel the customer service team is not as responsive or helpful as they would like.

Website and App Usability

Seven Corners’ website is generally considered easy to navigate, with clear and concise information on its various travel insurance plans. The website allows users to easily compare plans, get quotes, and purchase insurance online. However, some customers find the website’s design outdated or cluttered, making it difficult to find specific information.

- User-Friendly Features:The website offers helpful tools like a “Plan Comparison” feature that allows users to compare different plans side-by-side, making it easier to find the best coverage for their needs.

- Potential Improvements:While the website is functional, it could benefit from a modern design update and improved search functionality to enhance the user experience.

Customer Service Comparison

Seven Corners’ customer service is generally regarded as responsive and helpful. The company offers multiple contact options, including phone, email, and live chat.

- Strengths:Seven Corners’ customer service representatives are typically knowledgeable about their products and can provide assistance with policy questions, claims filing, and other inquiries.

- Comparison to Competitors:Compared to competitors like World Nomads and Allianz, Seven Corners’ customer service is considered to be on par in terms of responsiveness and helpfulness.

Factors to Consider When Choosing Seven Corners Travel Insurance

Choosing the right travel insurance plan is crucial for ensuring peace of mind and financial protection during your travels. Seven Corners offers a range of plans, and selecting the most suitable one depends on your individual circumstances, travel style, and budget.

Evaluating Travel Insurance Needs Based on Individual Circumstances

Travel insurance is not a one-size-fits-all solution. It’s important to consider your unique needs and circumstances to choose a plan that provides adequate coverage. For example, a traveler on a budget might prioritize basic medical coverage, while a traveler with pre-existing conditions may require more comprehensive coverage.

Key Factors to Consider When Choosing a Seven Corners Travel Insurance Plan

Several key factors can help you determine the best Seven Corners travel insurance plan for your needs:

Destination

The destination of your trip plays a crucial role in determining the type of coverage you need. For example, if you’re traveling to a country with a high risk of medical emergencies, you might want to consider a plan with comprehensive medical coverage.

Similarly, if you’re traveling to a country with a high risk of natural disasters, you might want to consider a plan with coverage for natural disaster evacuation.

Travel Style

Your travel style also influences the type of coverage you need. For example, if you’re an adventure traveler, you might want to consider a plan with coverage for adventure activities. Similarly, if you’re traveling with children, you might want to consider a plan with coverage for child-specific needs.

Budget

Your budget is a significant factor when choosing travel insurance. Seven Corners offers a range of plans with varying premiums, and it’s important to choose a plan that fits your budget while providing adequate coverage.

Seven Corners Travel Insurance Checklist

Here’s a checklist to help you make an informed decision about Seven Corners travel insurance:

- What is your destination?

- What is your travel style?

- What is your budget?

- What is your age and health status?

- Do you have any pre-existing medical conditions?

- Are you traveling with children?

- What are your travel plans?

- What is the duration of your trip?

- What are your coverage needs?

Once you’ve considered these factors, you can start comparing Seven Corners travel insurance plans and choose the one that best meets your needs.

Alternatives to Seven Corners Travel Insurance

When searching for travel insurance, Seven Corners is not the only option available. Numerous other reputable providers offer comprehensive coverage and competitive rates. Exploring these alternatives can help you find the best fit for your specific needs and budget.

Comparison of Features and Benefits

It’s important to compare the features and benefits offered by different providers to make an informed decision. Some key aspects to consider include:

- Coverage Types:Most travel insurance providers offer various plans, including single-trip, multi-trip, and annual plans. Consider your travel frequency and duration to choose the appropriate plan.

- Coverage Limits:Each plan has coverage limits for specific events, such as medical expenses, trip cancellation, and baggage loss. Ensure the limits align with your potential risks and financial needs.

- Exclusions and Limitations:Pay attention to any exclusions or limitations within the policy, such as pre-existing conditions, adventure sports, or certain destinations.

- Customer Service:A responsive and reliable customer service team is crucial in case of emergencies or claims. Check reviews and ratings to gauge the provider’s reputation for customer support.

- Pricing:Compare premiums from different providers based on your trip details, age, and coverage levels. Consider the value proposition and ensure the price reflects the coverage you receive.

Key Differences Between Seven Corners and Competitors

While Seven Corners offers comprehensive coverage and competitive pricing, it’s essential to understand its key differences from other providers.

- Specialization:Seven Corners specializes in adventure travel insurance, offering plans tailored to specific activities like scuba diving, skiing, and trekking. Other providers may focus on more general travel insurance needs.

- Plan Options:Some competitors may offer a wider range of plan options, including more budget-friendly choices or plans with specific benefits tailored to certain demographics.

- Customer Reviews:Customer reviews can provide insights into the overall experience with different providers. Compare feedback on aspects like claim processing, customer service responsiveness, and overall satisfaction.

Reputable Travel Insurance Providers

Here are some well-regarded travel insurance providers to consider as alternatives to Seven Corners:

- World Nomads:Known for its comprehensive coverage and user-friendly platform, World Nomads offers plans for various travel styles, including backpacking, adventure travel, and digital nomad work.

- Allianz Travel Insurance:A global provider with a wide range of plans, Allianz offers coverage for various travel needs, including medical expenses, trip cancellation, and baggage loss.

- Travel Guard:Travel Guard specializes in comprehensive travel insurance, offering plans with various benefits, including trip cancellation, medical expenses, and travel delay coverage.

- InsureMyTrip:A comparison website, InsureMyTrip allows you to compare quotes from multiple providers, making it easier to find the best value for your needs.

Tips for Using Seven Corners Travel Insurance

Making the most of your Seven Corners travel insurance means understanding the policy’s nuances and taking proactive steps to ensure a smooth claims process. This involves knowing your coverage details, following specific procedures, and keeping detailed records.

Understanding Your Coverage

It’s crucial to thoroughly understand your policy’s terms and conditions. This includes knowing your coverage limits, deductibles, and any exclusions.

- Familiarize yourself with the specific types of events covered by your plan. For example, some plans may cover medical emergencies, while others may include coverage for trip cancellation or interruption.

- Review the policy document carefully to identify any limitations or restrictions on coverage.

- Understand the process for filing a claim, including the required documentation and deadlines.

The Claims Process

Filing a claim with Seven Corners involves providing accurate and complete information to support your request. This includes:

- A detailed description of the event that led to the claim.

- Supporting documentation, such as medical bills, receipts, or police reports.

- Contact information for the relevant parties, such as doctors, hospitals, or airlines.

Documenting Your Trip

Keeping detailed records of your trip is essential for any potential claim. This includes:

- Maintaining copies of your travel documents, such as your passport, visas, and tickets.

- Recording details of your itinerary, including dates, times, and locations.

- Keeping receipts for all travel-related expenses, including accommodation, meals, and transportation.

- Taking photographs or videos of any incidents or events that may lead to a claim.

Avoiding Common Mistakes

There are several common mistakes travelers make that can hinder their claims process:

- Not reading the policy thoroughly before traveling.

- Failing to provide complete and accurate information when filing a claim.

- Missing deadlines for filing claims.

- Not keeping proper documentation of their trip.

Ensuring a Smooth Experience

To ensure a smooth claims process, consider these tips:

- Contact Seven Corners immediately if you encounter any issues during your trip that may lead to a claim.

- Keep all documentation organized and readily accessible.

- Be patient and cooperative with the claims process.

- Follow all instructions provided by Seven Corners.

Closing Notes

When choosing travel insurance, it’s crucial to assess your individual needs and travel plans. Seven Corners offers a range of options to suit various budgets and travel styles. By understanding the different plans, coverage options, and benefits, you can make an informed decision and select the policy that best aligns with your travel aspirations.

Remember, investing in travel insurance is an investment in your peace of mind, ensuring you can enjoy your trip knowing you’re protected in case of unforeseen circumstances.

Key Questions Answered

What types of travel insurance plans does Seven Corners offer?

Seven Corners offers a variety of travel insurance plans, including single-trip, multi-trip, family, and specialized plans for specific activities like adventure travel or cruises.

Does Seven Corners cover pre-existing medical conditions?

Some Seven Corners plans may offer coverage for pre-existing conditions, but it’s important to check the policy details and ensure your condition is covered.

How do I file a claim with Seven Corners?

You can file a claim online through the Seven Corners website or by contacting their customer service team.

What is the maximum coverage amount for medical expenses?

The maximum coverage amount for medical expenses varies depending on the specific plan you choose. Review the policy details for the exact coverage limits.