Term life insurance quotes are a crucial starting point for securing financial protection for your loved ones. By understanding the factors that influence these quotes, you can make informed decisions and find the best policy for your needs and budget.

This guide will explore the intricacies of term life insurance quotes, providing insights into how they are calculated, what factors affect their cost, and how to compare quotes from different insurers. We will also delve into the essential features of a term life insurance policy, empowering you to make a confident choice.

Understanding Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period, typically 10, 20, or 30 years. It is designed to provide financial protection to your loved ones in the event of your death during the policy term.

If you die within the policy term, your beneficiaries will receive a death benefit, a predetermined sum of money.

Key Features of Term Life Insurance

The following are the key features of term life insurance:

- Coverage Period:Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. After the coverage period expires, the policy can be renewed, but the premiums will likely increase due to your age.

- Premiums:Term life insurance premiums are typically lower than those for permanent life insurance policies, such as whole life or universal life. This is because term life insurance only provides coverage for a limited period and does not build cash value.

- Death Benefit:The death benefit is the amount of money your beneficiaries will receive if you die during the policy term. The death benefit is typically a fixed amount, but it can be adjusted to meet your changing needs.

Comparison with Other Types of Life Insurance

Term life insurance differs from other types of life insurance in several ways. Here’s a comparison:

| Type of Life Insurance | Coverage Period | Premiums | Death Benefit | Cash Value |

|---|---|---|---|---|

| Term Life | Specific period (e.g., 10, 20, or 30 years) | Lower | Fixed amount | None |

| Whole Life | Lifetime | Higher | Fixed amount | Builds cash value |

| Universal Life | Lifetime | Flexible | Adjustable | Builds cash value |

Term life insurance is often considered a good option for individuals who need temporary coverage, such as young families with mortgage debt or people with dependents. Whole life and universal life insurance, on the other hand, provide lifetime coverage and build cash value, making them suitable for long-term financial planning.

Importance of Getting Quotes

Term life insurance is a valuable financial tool that can help protect your loved ones in the event of your untimely passing. It provides a death benefit to your beneficiaries, allowing them to cover expenses like funeral costs, mortgage payments, and other financial obligations.

To ensure you get the best coverage at the most affordable price, obtaining quotes from multiple insurers is essential.

Benefits of Comparing Quotes

Comparing quotes from multiple insurers allows you to find the best possible value for your needs. By shopping around, you can identify policies that offer:

- Lower premiums: Different insurers use various pricing models, and some may offer lower rates than others. Comparing quotes can help you secure the most competitive price for the coverage you need.

- Wider coverage options: Insurers may offer different coverage amounts, durations, and optional riders. By comparing quotes, you can find a policy that best aligns with your specific needs and circumstances.

- Greater flexibility: Comparing quotes can provide you with more flexibility in choosing a policy that fits your budget and preferences. You may find policies with different premium payment options, coverage periods, or other features that suit your individual requirements.

Factors Influencing Term Life Insurance Quotes

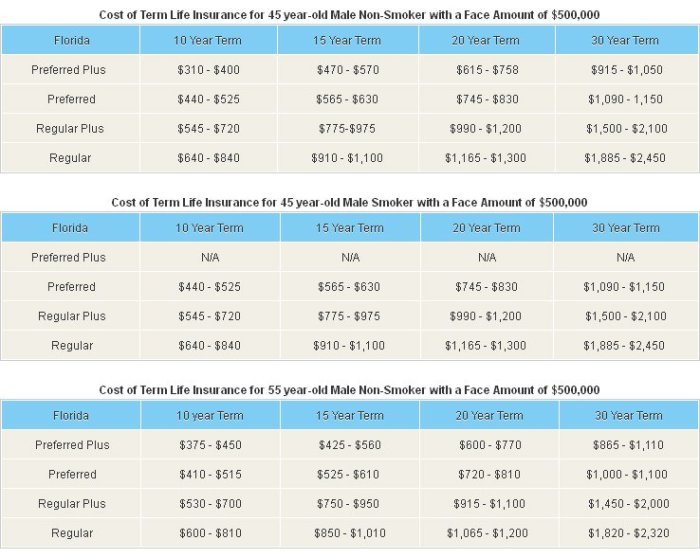

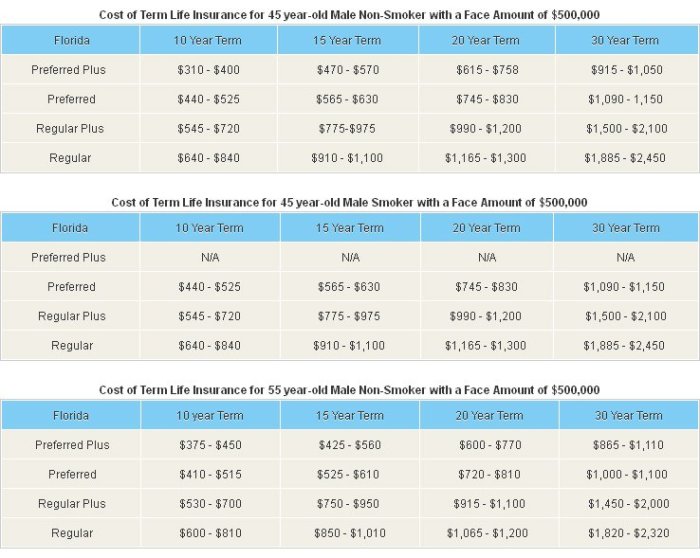

Several factors can influence the cost of term life insurance, including:

- Age: Younger individuals generally pay lower premiums than older individuals. This is because they have a lower risk of death, resulting in lower premiums.

- Health: Your health status plays a significant role in determining your premium. Insurers consider your medical history, current health conditions, and lifestyle habits to assess your risk profile. Individuals with pre-existing health conditions or unhealthy lifestyles may face higher premiums.

- Coverage amount: The amount of coverage you choose will directly impact your premium. Higher coverage amounts mean higher premiums, as the insurer is assuming a greater financial risk.

- Duration of coverage: The length of time you want your policy to remain in effect also influences the premium. Longer coverage terms typically result in higher premiums.

- Smoking status: Smokers are considered a higher risk group, leading to higher premiums. Insurers may charge significantly higher premiums for smokers compared to non-smokers.

Factors Affecting Quotes: Term Life Insurance Quotes

The cost of term life insurance is influenced by several factors, which insurers carefully consider when calculating your premiums. These factors help determine your individual risk profile, ultimately affecting how much you’ll pay for your policy.

Age, Term life insurance quotes

Your age is a significant factor in determining your term life insurance premiums. As you age, your risk of mortality increases, leading to higher premiums. This is because insurers statistically expect older individuals to have a higher chance of passing away during the policy term.

Health

Your overall health status plays a crucial role in determining your insurance premiums. Individuals with pre-existing health conditions or a history of serious illnesses may face higher premiums. Insurers may require medical examinations, blood tests, and other assessments to evaluate your health and assess your risk.

For example, a person with a history of heart disease may pay higher premiums than someone with a clean bill of health.

Coverage Amount

The amount of coverage you choose directly impacts your premiums. Higher coverage amounts mean higher premiums. This is because insurers assume a greater financial responsibility if a claim is filed for a larger death benefit.

Lifestyle Habits

Your lifestyle choices, particularly smoking and engaging in risky hobbies, can influence your insurance premiums. Smokers typically pay higher premiums due to their increased risk of health problems. Similarly, individuals who engage in extreme sports or dangerous activities may also face higher premiums.

Occupation

Your occupation can also impact your insurance premiums. Certain occupations, such as those involving hazardous work environments or high levels of stress, may be considered higher risk. Insurers may assess your job description and work environment to determine your risk level.

Gender

Historically, women have typically lived longer than men, leading to lower premiums for women. However, this trend is gradually changing, and some insurers now offer gender-neutral rates.

Location

Your location can influence your insurance premiums. Insurers consider factors such as the cost of living, crime rates, and access to healthcare in your area. For instance, individuals living in areas with high crime rates or limited healthcare access may face higher premiums.

Finding Quotes

Finding the right term life insurance policy involves comparing quotes from different insurance companies. This ensures you get the best coverage at the most affordable price. You can explore various options, both online and offline, to gather quotes and make informed decisions.

Online Resources and Platforms

Online platforms offer a convenient and efficient way to compare term life insurance quotes from multiple companies. Here are some reputable online resources:

- Insurance Comparison Websites:Websites like Policygenius, QuoteWizard, and The Balance specialize in comparing quotes from different insurance providers. These platforms allow you to enter your details once and receive multiple quotes, simplifying the comparison process.

- Insurance Company Websites:Most insurance companies have websites where you can request quotes directly. This allows you to explore specific company offerings and get a sense of their policies and pricing.

- Independent Insurance Agents:Independent insurance agents work with multiple insurance companies, giving you access to a wider range of options. They can provide personalized recommendations based on your specific needs.

Advantages and Disadvantages of Online Quote Comparison Tools

Online quote comparison tools can be helpful, but they also have limitations:

- Advantages:

- Convenience:You can get quotes from multiple companies in a short time, without leaving your home.

- Transparency:These tools often provide clear and concise information about each policy, making it easier to compare coverage and pricing.

- Potential Savings:Comparing quotes can help you find the most affordable policy for your needs.

- Disadvantages:

- Limited Information:Online tools may not provide all the details about a policy, such as exclusions or limitations.

- Potential Bias:Some websites may prioritize certain companies or policies based on their affiliations or commissions.

- Lack of Personalization:Online tools cannot provide the same level of personalized advice as an independent insurance agent.

Using Online Resources Effectively

To maximize the benefits of online quote comparison tools:

- Be Honest and Accurate:Provide accurate information about your age, health, smoking status, and other relevant factors. This ensures you receive accurate quotes that reflect your individual circumstances.

- Compare Apples to Apples:Make sure you are comparing quotes for similar coverage amounts, policy terms, and benefits. This allows for a fair comparison and helps you identify the best value.

- Read the Fine Print:Before making a decision, carefully review the policy details, including exclusions, limitations, and any potential waiting periods.

- Consider Your Needs:Don’t just focus on the lowest price. Think about your specific needs and choose a policy that provides the right level of coverage and protection.

- Seek Professional Advice:If you are unsure about which policy is right for you, consult with an independent insurance agent or financial advisor. They can provide personalized guidance and help you make an informed decision.

Analyzing Quotes

You’ve gathered several term life insurance quotes, and now it’s time to analyze them carefully to find the best option for your needs. This involves comparing different aspects of each quote, understanding the terms and conditions, and considering your individual circumstances.

Coverage Amount

The coverage amount, or death benefit, is the sum of money your beneficiaries will receive upon your death. It’s crucial to choose a coverage amount that adequately protects your loved ones and covers their financial needs.

- Determine your family’s financial obligations, such as mortgage payments, outstanding debts, college tuition, and living expenses.

- Consider your dependents’ ages and their future financial needs.

- Factor in inflation, as the cost of living will likely increase over time.

- Compare the coverage amounts offered by different insurers and choose a policy that meets your requirements.

Premium

The premium is the amount you pay regularly for your term life insurance policy. It’s important to find a policy with a premium that fits your budget and financial situation.

- Compare the premiums quoted by different insurers for the same coverage amount and term length.

- Consider the frequency of premium payments (monthly, quarterly, annually) and the overall cost of the policy.

- Remember that lower premiums may come with shorter term lengths or less coverage, so it’s important to balance affordability with your needs.

Policy Features

Beyond the basic coverage amount and premium, term life insurance policies can have various features that affect their value.

- Guaranteed Insurability Rider:This rider allows you to purchase additional coverage at specific intervals without needing to undergo a medical exam, even if your health changes.

- Accidental Death Benefit Rider:This rider provides an additional death benefit if your death is caused by an accident.

- Waiver of Premium Rider:This rider waives your premium payments if you become disabled and unable to work.

- Living Benefits Rider:This rider allows you to access a portion of your death benefit while you’re still alive, if you have a terminal illness or critical illness.

Insurer Reputation

The reputation of the insurer is an essential factor to consider. You want to choose a financially stable and reliable insurer with a proven track record of paying claims promptly and fairly.

- Research the insurer’s financial ratings from agencies like A.M. Best and Standard & Poor’s.

- Read customer reviews and testimonials to gauge the insurer’s customer service and claims handling processes.

- Look for insurers with a history of strong financial performance and a commitment to customer satisfaction.

Negotiating with Insurers

While term life insurance premiums are generally standardized, there’s often room for negotiation, especially if you’re a good candidate with a healthy lifestyle and a strong financial history.

- Shop around:Get quotes from multiple insurers and compare their offers side-by-side. This gives you leverage during negotiations.

- Ask about discounts:Inquire about potential discounts for non-smokers, healthy habits, or group affiliations.

- Be prepared to walk away:If you’re not satisfied with the insurer’s offer, be prepared to walk away and consider other options. This shows you’re serious and willing to find the best deal.

Understanding Policy Features

Once you’ve obtained quotes and are ready to move forward, it’s crucial to carefully review the policy features of each option. These features directly impact the coverage and cost of your policy, so understanding them is essential for making an informed decision.

Death Benefit

The death benefit is the core of any term life insurance policy. This is the amount of money your beneficiaries will receive upon your death. The death benefit amount is typically chosen based on your financial needs and obligations, such as covering a mortgage, replacing lost income, or funding your children’s education.

Premium Payment Period

The premium payment period refers to the duration you’ll be making premium payments for the policy. It’s usually a fixed period, such as 10, 20, or 30 years. You can choose a premium payment period that aligns with your financial goals and the length of time you need life insurance coverage.

Coverage Period

The coverage period defines how long your term life insurance policy will remain active. This is typically a fixed term, such as 10, 20, or 30 years. At the end of the coverage period, the policy expires, and you will no longer have coverage unless you renew it.

Renewal Options

Term life insurance policies typically offer renewal options at the end of the coverage period. This allows you to extend your coverage for another term, though the premium will likely increase based on your age and health at the time of renewal.

- Guaranteed Renewable:This option guarantees you the right to renew your policy, regardless of your health status. However, the premium will likely be higher than your initial premium.

- Convertible:This option allows you to convert your term life insurance policy to a permanent life insurance policy, such as whole life or universal life, without undergoing a medical exam. This can be beneficial if you want lifelong coverage but prefer the lower premiums of a term policy.

Riders and Add-ons

Riders and add-ons are optional features that can be added to your term life insurance policy to enhance its coverage or provide additional benefits. Some common riders include:

- Accidental Death Benefit Rider:This rider pays a lump sum benefit if you die due to an accident.

- Waiver of Premium Rider:This rider waives your premium payments if you become disabled and unable to work.

- Living Benefits Rider:This rider allows you to access a portion of your death benefit while you are still alive, typically for critical illness or long-term care expenses.

Choosing the Right Policy

You’ve compared quotes and understand the basics of term life insurance. Now, it’s time to choose the policy that best fits your needs and financial situation.

Factors to Consider When Choosing a Term Life Insurance Policy

Making the right choice involves considering several factors. Here’s a checklist to help you navigate the process:

- Coverage Amount:Determine the appropriate coverage amount based on your dependents’ financial needs and your outstanding debts. Consider factors like mortgage, education expenses, and living expenses. A financial advisor can help you calculate the ideal coverage amount.

- Term Length:Choose a term length that aligns with your coverage needs. Consider the duration for which you require protection, such as the time until your children are financially independent or your mortgage is paid off.

- Premium Payments:Evaluate the affordability of premiums and ensure they fit within your budget. Consider factors like your age, health, and lifestyle when assessing the premium cost.

- Riders:Explore additional riders that enhance your policy’s coverage. These riders can provide benefits like accidental death coverage, terminal illness coverage, or waiver of premium benefits. Choose riders that address your specific needs and concerns.

- Company Reputation:Research the financial stability and reputation of the insurance company. Look for companies with strong financial ratings and a history of reliable claim payouts.

- Policy Features:Compare policy features such as renewability, convertibility, and the availability of premium payment options. Ensure the policy aligns with your long-term financial planning goals.

Tips for Making an Informed Decision

- Compare Apples to Apples:Ensure you’re comparing similar policies with comparable coverage amounts, term lengths, and features. This allows for a fair and accurate comparison.

- Seek Expert Advice:Consult a financial advisor or insurance agent for personalized guidance. They can help you understand complex insurance terms and make informed decisions based on your specific circumstances.

- Read the Fine Print:Thoroughly review the policy document before signing. Pay close attention to exclusions, limitations, and any specific conditions that might affect your coverage.

- Consider Your Future:Think about your future financial needs and how they might change over time. Choose a policy that offers flexibility and adapts to your evolving circumstances.

Importance of Seeking Advice from a Financial Advisor or Insurance Agent

- Personalized Guidance:A financial advisor or insurance agent can provide tailored recommendations based on your individual needs and financial situation. They can help you determine the appropriate coverage amount, term length, and policy features.

- Objective Perspective:They offer an objective perspective and can help you navigate the complex world of insurance. They can explain insurance jargon and ensure you understand the terms and conditions of your policy.

- Access to Resources:They have access to a wide range of insurance products and can help you compare different options from various insurance companies.

Concluding Remarks

Armed with the knowledge gained from this guide, you are now equipped to navigate the world of term life insurance quotes. Remember to compare quotes from multiple insurers, consider your individual needs and financial circumstances, and seek professional advice if necessary.

By taking these steps, you can ensure that you secure a term life insurance policy that provides the right level of coverage at a competitive price.

Answers to Common Questions

How long does it take to get a term life insurance quote?

The time it takes to receive a term life insurance quote varies depending on the insurer and the complexity of your application. You can often get a preliminary quote online within minutes, but a more detailed quote, including a medical exam, may take a few days or weeks.

Can I get a term life insurance quote without providing personal information?

While some online tools may offer preliminary quotes without requiring personal information, you will typically need to provide details like your age, gender, health status, and desired coverage amount to get an accurate quote.

What happens if my health changes after I get a quote?

If your health changes significantly after receiving a quote, you may need to reapply for insurance. The insurer will assess your current health status and adjust the quote accordingly.

Can I get a term life insurance quote if I have a pre-existing condition?

Yes, you can still get a term life insurance quote even if you have a pre-existing condition. However, the cost of your premium may be higher depending on the severity and type of condition.