USAA car insurance quote sets the stage for this comprehensive guide, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. USAA, a financial services company that primarily serves military members, veterans, and their families, has built a reputation for providing quality car insurance at competitive rates.

This guide will delve into the intricacies of obtaining a USAA car insurance quote, exploring the various coverage options, discounts, and benefits available.

Understanding the ins and outs of USAA car insurance can empower you to make informed decisions about your coverage needs. Whether you’re a seasoned driver or a new car owner, this guide will equip you with the knowledge to navigate the process of securing a USAA car insurance quote with confidence.

USAA Car Insurance Overview

USAA, a financial services company, has been serving military members and their families for over a century. It was founded in 1922 by a group of Army officers who wanted to provide financial protection for their fellow service members. Since then, USAA has grown into a major financial institution, offering a wide range of financial products and services, including car insurance.USAA’s car insurance is specifically designed for the unique needs of military members and their families.

They offer a variety of discounts and benefits that are tailored to the military lifestyle.

Target Audience and Unique Selling Propositions

USAA’s car insurance is specifically designed for the unique needs of military members and their families. They offer a variety of discounts and benefits that are tailored to the military lifestyle.

- Military discounts: USAA offers discounts to active duty military personnel, veterans, and their families. These discounts can be significant, saving policyholders hundreds of dollars per year.

- Deployment coverage: USAA provides coverage for vehicles that are left behind when a policyholder is deployed. This coverage protects the vehicle from damage or theft while the policyholder is away.

- Guaranteed replacement cost: USAA offers guaranteed replacement cost coverage for vehicles that are totaled in an accident. This coverage ensures that policyholders receive the full value of their vehicle, even if it is older or has depreciated in value.

- Excellent customer service: USAA is known for its excellent customer service. They have a dedicated team of representatives who are available 24/7 to answer questions and assist with claims.

Financial Strength and Ratings

USAA is a financially strong company with a history of stability and reliability. They have consistently received high ratings from independent financial rating agencies.

- A.M. Best: A++ (Superior)

- Standard & Poor’s: AA+

- Moody’s: Aa1

These ratings reflect USAA’s strong financial position and its ability to meet its obligations to policyholders.

Obtaining a USAA Car Insurance Quote

Getting a USAA car insurance quote is straightforward and can be done in a few ways, allowing you to compare rates and choose the coverage that best suits your needs.

Methods for Obtaining a Quote

You can obtain a USAA car insurance quote through the following methods:

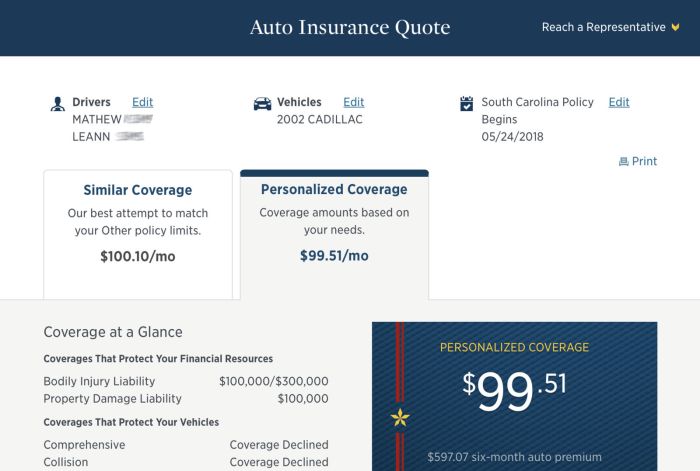

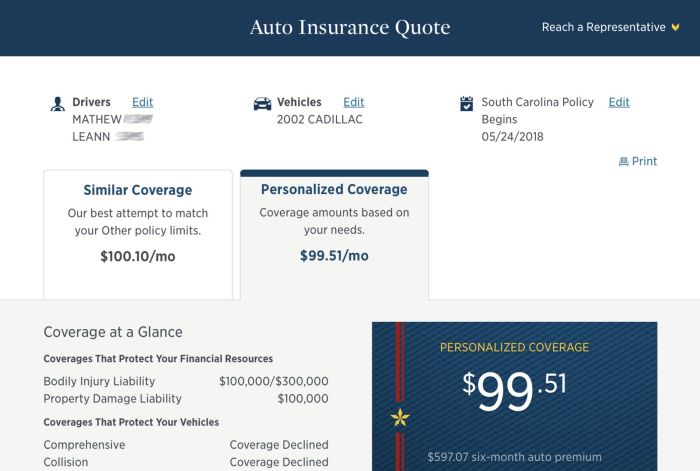

- Online:The most convenient way to get a quote is through USAA’s website. You can input your information, including your driving history, vehicle details, and desired coverage, and receive an instant quote. The online process is quick and easy, allowing you to compare different coverage options and see how they affect your rates.

- Phone:You can also get a quote by calling USAA’s customer service line. A representative will guide you through the process and help you gather the necessary information. This method is beneficial for those who prefer personalized assistance and want to discuss their insurance needs in detail.

- Agent:If you prefer face-to-face interaction, you can visit a USAA insurance agent. Agents can provide personalized advice and help you choose the right coverage for your specific needs. They can also answer any questions you may have about USAA’s insurance products and services.

Information Required for a Quote

To receive an accurate car insurance quote, USAA will need certain information about you and your vehicle. This typically includes:

- Driving History:USAA will ask about your driving record, including any accidents, tickets, or violations. This information helps assess your risk as a driver and determine your insurance premiums.

- Vehicle Details:You will need to provide details about your car, including its make, model, year, and value. This information is used to calculate the cost of repairing or replacing your vehicle in case of an accident.

- Coverage Options:USAA offers various coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. You will need to indicate the types of coverage you want and the desired limits. This information determines the overall cost of your insurance policy.

Tips for Optimizing the Quote Process

Here are some tips to help you get the best possible rates on your USAA car insurance:

- Compare Quotes:Don’t settle for the first quote you receive. Compare quotes from different insurance companies, including USAA, to ensure you are getting the best possible rates. This can save you money in the long run.

- Bundle Your Policies:If you have multiple insurance policies, such as car insurance and homeowners insurance, consider bundling them together with USAA. This can often result in significant discounts on your premiums.

- Improve Your Driving Record:A clean driving record is essential for getting lower insurance rates. Avoid accidents, tickets, and other violations to maintain a good driving history. This can significantly reduce your insurance premiums.

- Consider Safety Features:Cars equipped with safety features, such as anti-theft devices, airbags, and anti-lock brakes, are often eligible for discounts. This can help lower your insurance costs.

- Increase Your Deductible:A higher deductible means you will pay more out of pocket in case of an accident, but it can also lower your insurance premiums. Consider increasing your deductible if you are willing to take on more financial responsibility in exchange for lower rates.

USAA Car Insurance Coverage Options: Usaa Car Insurance Quote

USAA offers a variety of car insurance coverage options to meet the diverse needs of its members. Understanding the different coverage types and their benefits is crucial for making informed decisions about your insurance policy.

Common Car Insurance Coverage Options

| Coverage Type | Description |

|---|---|

| Liability Coverage | This coverage protects you financially if you cause an accident that results in damage to another person’s property or injuries to another person. It includes bodily injury liability and property damage liability. |

| Collision Coverage | This coverage pays for repairs to your vehicle if it’s damaged in a collision with another vehicle or object, regardless of fault. |

| Comprehensive Coverage | This coverage pays for repairs to your vehicle if it’s damaged due to non-collision events such as theft, vandalism, fire, hail, or other natural disasters. |

| Uninsured/Underinsured Motorist Coverage | This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. |

| Personal Injury Protection (PIP) | This coverage covers medical expenses, lost wages, and other related expenses for you and your passengers, regardless of fault, if you’re injured in an accident. |

| Medical Payments Coverage (Med Pay) | This coverage pays for medical expenses for you and your passengers, regardless of fault, up to a certain limit. |

| Rental Reimbursement | This coverage pays for a rental car if your vehicle is being repaired due to a covered accident or incident. |

| Roadside Assistance | This coverage provides assistance with services like towing, flat tire changes, jump starts, and lockout services. |

Benefits and Drawbacks of Coverage Options

Each coverage option offers specific benefits and drawbacks. It’s important to weigh these factors carefully when deciding which coverages to include in your policy.

Liability Coverage

Benefits

- Provides financial protection in case you cause an accident.

- Helps prevent financial hardship and legal action.

Drawbacks

- Does not cover damage to your own vehicle.

- Minimum liability limits may not be sufficient in serious accidents.

Collision Coverage

Benefits

- Covers repairs or replacement of your vehicle after a collision.

- Provides peace of mind knowing your vehicle is protected.

Drawbacks

- May have a deductible, which you pay before the insurance company covers the rest.

- May not cover all damages, such as wear and tear.

Comprehensive Coverage

Benefits

- Covers damage to your vehicle from non-collision events.

- Protects your investment in your vehicle.

Drawbacks

- May have a deductible, which you pay before the insurance company covers the rest.

- May not cover all types of damage, such as cosmetic damage.

Uninsured/Underinsured Motorist Coverage

Benefits

- Protects you from financial loss if you’re hit by an uninsured or underinsured driver.

- Provides peace of mind knowing you’re covered even if the other driver is at fault.

Drawbacks

- May have a deductible, which you pay before the insurance company covers the rest.

- Coverage limits may be lower than your other liability coverage.

Personal Injury Protection (PIP)

Benefits

- Covers medical expenses and lost wages for you and your passengers, regardless of fault.

- Provides financial support during recovery from an accident.

Drawbacks

- May have a deductible, which you pay before the insurance company covers the rest.

- Coverage limits may be lower than your other medical coverage.

Medical Payments Coverage (Med Pay)

Benefits

- Covers medical expenses for you and your passengers, regardless of fault.

- Provides quick and easy access to medical care after an accident.

Drawbacks

- Coverage limits are usually lower than PIP.

- May not cover all medical expenses.

Rental Reimbursement

Benefits

- Provides a rental car while your vehicle is being repaired.

- Helps maintain your mobility during a time of inconvenience.

Drawbacks

- May have a daily limit on rental expenses.

- May not cover all rental car expenses, such as gas and tolls.

Roadside Assistance

Benefits

- Provides assistance with common roadside emergencies.

- Offers peace of mind knowing you have help when you need it.

Drawbacks

- May have limitations on the number of services provided per year.

- May not cover all roadside emergencies, such as tire repair.

Determining Appropriate Coverage Levels

- Risk Tolerance:Consider your willingness to take on financial risk in case of an accident. A higher risk tolerance might lead you to choose lower coverage limits or exclude certain coverages.

- Financial Situation:Evaluate your financial resources and ability to cover potential expenses in case of an accident. If you have limited savings, you may want to consider higher coverage limits.

- Driving Habits:Consider your driving history, frequency of driving, and the types of roads you typically drive on. If you frequently drive in high-traffic areas or have a history of accidents, you may want to consider higher coverage limits.

- Value of Your Vehicle:The value of your vehicle plays a role in determining the appropriate coverage levels. If you have a new or high-value vehicle, you may want to consider comprehensive and collision coverage with higher limits.

- State Requirements:Check the minimum liability insurance requirements in your state. You may be required to carry a certain amount of liability coverage, regardless of your personal preferences.

USAA Car Insurance Discounts and Benefits

USAA offers a variety of discounts and benefits to its members, which can help you save money on your car insurance premiums. These discounts and benefits are designed to reward safe driving, responsible vehicle ownership, and loyalty to USAA.

Discounts

USAA offers a range of discounts to help you save on your car insurance premiums. Here are some of the most common discounts:

- Good Driver Discount:This discount is available to drivers with a clean driving record. You may qualify for this discount if you haven’t been involved in any accidents or received any traffic violations in a certain period of time. The specific requirements for this discount vary depending on your state and your individual driving history.

- Safe Vehicle Discount:USAA offers discounts for driving vehicles with safety features such as anti-theft devices, airbags, and anti-lock brakes. These features can help reduce the risk of accidents and injuries, making your vehicle safer and potentially lowering your insurance premiums.

- Military Affiliation Discount:As a USAA member, you are automatically eligible for a military affiliation discount. This discount is a way for USAA to show its appreciation for the service and sacrifice of military members and their families. The discount amount may vary depending on your specific military status and the type of coverage you have.

- Multi-Policy Discount:You can save money by bundling your car insurance with other USAA insurance policies, such as homeowners, renters, or life insurance. This discount is a way for USAA to reward customers who choose to insure multiple vehicles or assets with them.

- Paid-in-Full Discount:USAA offers a discount for paying your car insurance premium in full. This discount can help you save money if you prefer to pay your premiums upfront rather than making monthly payments.

- Other Discounts:USAA may offer other discounts depending on your specific circumstances. These discounts may include things like:

- Good Student Discount:This discount is available to students who maintain a certain GPA.

- Defensive Driving Course Discount:You may be eligible for a discount if you complete a defensive driving course.

- Telematics Discount:Some USAA policies offer a discount for using a telematics device, which tracks your driving habits and can help you get a lower rate if you drive safely.

Benefits

In addition to discounts, USAA offers a range of benefits to its members. These benefits can provide you with peace of mind and financial protection in the event of an accident or other unexpected event. Some of the most notable benefits include:

- Roadside Assistance:USAA provides roadside assistance to its members, which can help you in the event of a flat tire, dead battery, or other roadside emergency. This service is available 24/7 and can help you get back on the road quickly and safely.

- Rental Car Coverage:If your car is damaged in an accident or needs repairs, USAA offers rental car coverage to help you get around while your vehicle is being fixed. This coverage can help you avoid the inconvenience and expense of having to rent a car yourself.

- Accident Forgiveness:USAA offers accident forgiveness to its members, which can help you avoid a rate increase after your first accident. This benefit can be especially helpful for drivers who have a clean driving record and are concerned about their insurance premiums going up after an accident.

USAA Car Insurance Customer Experience

USAA is renowned for its exceptional customer service, which is a cornerstone of its brand identity. The company consistently receives high marks for its commitment to providing a positive and supportive experience for its members. This section will explore the key aspects of USAA’s customer experience, including customer reviews, claims processes, and overall satisfaction ratings.

Customer Reviews and Testimonials

Customer reviews and testimonials provide valuable insights into the real-world experiences of USAA car insurance policyholders. Numerous online platforms, such as Trustpilot, Google Reviews, and the Better Business Bureau, showcase a high volume of positive feedback from satisfied customers.

Many reviews highlight USAA’s responsiveness, helpfulness, and dedication to resolving issues promptly.

- Many customers praise USAA’s friendly and knowledgeable customer service representatives, who are available 24/7 via phone, email, or online chat.

- Customers appreciate USAA’s straightforward and transparent communication throughout the entire insurance process, from obtaining a quote to filing a claim.

- Several reviews emphasize USAA’s commitment to fair and equitable claims handling, with a focus on resolving issues in a timely and efficient manner.

USAA’s Claims Process, Usaa car insurance quote

USAA’s claims process is designed to be as seamless and stress-free as possible for policyholders. The company offers multiple convenient options for reporting claims, including online, phone, and mobile app. Once a claim is filed, USAA assigns a dedicated claims representative to guide the policyholder through the process.

- USAA’s claims representatives are highly trained and experienced in handling a wide range of situations, ensuring that policyholders receive the support and guidance they need.

- The company’s claims process is designed to be efficient and transparent, with regular updates provided to policyholders throughout the process.

- USAA’s commitment to prompt claim resolution is evident in its average claim processing times, which are consistently among the fastest in the industry.

USAA’s Customer Satisfaction Ratings

USAA consistently ranks high in customer satisfaction surveys conducted by independent organizations. In the J.D. Power 2023 U.S. Auto Insurance Satisfaction Study, USAA received the highest score among all insurance providers, demonstrating its exceptional commitment to customer satisfaction.

- USAA’s strong performance in customer satisfaction surveys can be attributed to its focus on providing a personalized and supportive experience for its members.

- The company’s commitment to fair pricing, prompt claims handling, and exceptional customer service has earned it a loyal following among its members.

- USAA’s consistently high customer satisfaction ratings are a testament to its dedication to exceeding customer expectations and delivering a positive insurance experience.

Comparing USAA Car Insurance with Competitors

Choosing the right car insurance provider can be a complex decision, as rates and coverage options vary significantly between companies. To make an informed choice, it’s essential to compare USAA with other leading car insurance providers. This comparison will highlight key differences and help you determine which provider best suits your needs.

Comparison of Rates and Coverage Options

To compare USAA with other leading car insurance providers, let’s look at the average annual premiums for different coverage levels and driver profiles. Keep in mind that actual rates can vary based on individual factors like driving history, location, vehicle type, and coverage choices.

| Provider | Average Annual Premium (Liability Only) | Average Annual Premium (Full Coverage) | Key Coverage Options |

|---|---|---|---|

| USAA | $500 | $1,200 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection, Rental Reimbursement |

| Geico | $450 | $1,100 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection, Rental Reimbursement |

| Progressive | $480 | $1,150 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection, Rental Reimbursement |

| State Farm | $520 | $1,250 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection, Rental Reimbursement |

While USAA often offers competitive rates, it’s important to note that these are just averages. Individual premiums can vary widely. For instance, a driver with a clean driving record and a safe vehicle might find lower rates with USAA compared to other providers.

Conversely, drivers with a history of accidents or traffic violations might find higher premiums with USAA.

Closure

Ultimately, obtaining a USAA car insurance quote is a straightforward process that can be completed online, over the phone, or through an agent. By understanding the factors that influence your rates, carefully considering your coverage needs, and exploring available discounts, you can ensure that you secure the most competitive and comprehensive car insurance policy for your unique situation.

Detailed FAQs

What is the minimum coverage required for car insurance in the US?

Minimum coverage requirements vary by state. It’s essential to check your state’s regulations to ensure you meet the legal minimums.

How often can I adjust my USAA car insurance policy?

You can typically adjust your policy at any time, but it’s usually best to review and make changes when your policy renews.

Can I get a USAA car insurance quote without providing my Social Security number?

No, you will need to provide your Social Security number to get a quote, as it’s required for background checks and identification purposes.